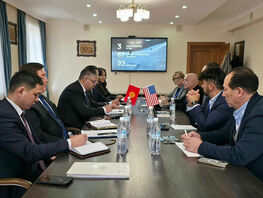

A meeting with the U.S. Ambassador to the Kyrgyz Republic Lesslie Viguerie took plce in the Administration of the President of Kyrgyzstan, dedicated to compliance with international sanctions imposed by America, the European Union and Great Britain, and the measures that the country is taking to prevent their circumvention. The press service of the Cabinet of Ministers reported.

It is noted that during the dialogue, the U.S. Ambassador informed about the risks for Kyrgyz entities engaged in foreign economic activity in the event of their involvement in circumventing sanctions requirements.

The Cabinet of Ministers assured that the republic is taking all necessary measures to comply with the sanctions regime in accordance with national legislation and is promptly working with participants in the financial market and foreign economic activity to prevent the circumvention of sanctions.

In order to systematize and monitor trade and financial transactions, especially those that do not involve the direct supply of goods to the Kyrgyz Republic, as well as to reduce the risks of circumventing sanctions and illegal payments, on September 10 last year, the Ministry of Economy established Trading Company of the Kyrgyz Republic JSC.

The Cabinet of Ministers noted that the main tasks of this organization are to check transactions for the presence of goods from the sanctions lists, prevent participation in schemes with dual-use goods and exclude transactions with companies under sanctions.

According to officials, each application undergoes a multi-stage check, including an analysis of product codes and a compliance check in commercial banks. If sanctioned goods are found in the application, the Trading Company rejects it.

It is specified that from September 2024 to May 2025, more than 50 applications were rejected due to sanctions risks.

Another link in the system of compliance with the sanctions regime is, according to the Cabinet of Ministers, Capital Bank of Central Asia OJSC, 100 percent of its shares belong to the Ministry of Finance.

The Cabinet of Ministers noted that the bank operates in strict accordance with the country’s legislation and international standards, including measures to combat money laundering and comply with sanctions requirements. Capital Bank undergoes an independent audit annually by the international Grant Thornton network. In order to avoid the risk of residents and non-residents of Kyrgyzstan falling under secondary sanctions, Capital Bank has suspended all financial transactions with banks under restrictions since 2023.

Note

According to the order of the Cabinet of Ministers dated March 17, 2025, Capital Bank was designated as a settlement bank for participation in a pilot project to conduct transactions with the Russian ruble on the territory of the Kyrgyz Republic, which is aimed at ensuring the stability of the financial system. After the bank was assigned this status, the Ministry of Finance made a decision to completely cease all forms of interaction with foreign financial institutions under sanctions.